The frequent failure of M&A deals to meet financial expectations is linked most often to a lack of “cultural fit” between the two organizations.

It is inevitable that the union of two distinct organizations will create challenges. They come from different histories, employees, markets, etc.

Conventional wisdom suggests that companies should avoid any deal with the significant cultural mismatch. This is rooted in the fear that cultural differences are largely unmanageable and will undermine deal success. The most critical and most mismanaged element in this mix is talent management.

On the other hand, we have today’s business realities like increasing pace, the unpredictability of change, inability to adapt to change, and so on. In this scenario, strategic and financial imperatives will drive potential M&A deals.

In this business environment, companies no longer have the luxury of avoiding potential deals due to cultural issues.

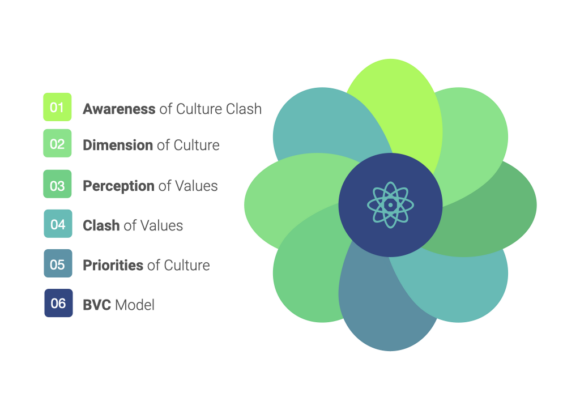

A smart stance is not to avoid deals where there is a risk of culture clash, but to manage and mitigate these risks. This has required companies to disaggregate defined “culture issues” into discrete, manageable issues.

M&A is typically a marriage of organizations. As in any marriage, there tend to be teething issues. These issues are complex since it involved two groups of people. The power dynamics of hierarchy makes it more deeply rooted.

We have seen that companies that modify their stance toward issues of cultural fit manage M&A well. This has worked best by ensuring a canvas for collage and co-creation.